Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, rose 0.5% for the week.

- The recent trend in rising productivity will have multiple positive ramifications for the economy, should it persist.

The Employment Cost Index (ECI) report, published by the Bureau of Labor Statistics (BLS) on Tuesday, reflected compensation costs to employers at a higher growth rate (1.2%) than what was expected for the first quarter of 2024. As most economists believe wage growth drives inflation, and inflation drives Federal Reserve contemplation of interest rate hikes, the ECI report was interpreted rather negatively by capital markets.

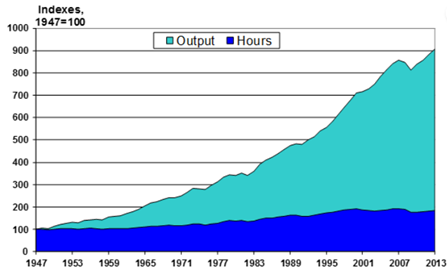

Another economic data point was released by the BLS this week: productivity, or how much output can be generated with a given input of labor hours worked. Economists believe that productivity is the key to raising living standards, gains in real wages, and growing corporate profits. Despite needing some updating, a chart from the BLS website nevertheless shows the importance of productivity from 1947 to 2013:

Chart: Bureau of Labor Statistics, 2024

Given the critical role of productivity to economic growth and our national well-being, one would think that a lot of focus would be given to that data’s publication by the BLS. Yet it was released without much (any) fanfare. For the record, productivity rose by 0.3% for the first quarter of 2024, rising by 2.9% over the last year, and has shown meaningful acceleration over the last 18 months.

Productivity can be driven by capital investment (machines, technology, etc.), which has increased recently but has not been spectacular over the last few years. The economist Skanda Amarnath points to healing supply chains and lower commodity prices but concludes that the driving force behind rising productivity has been the tight post-COVID labor market.

As the economy has been running at full employment, firms have had to become more productive to grow. Over the last two years, the fully employed workforce in the US has likely become more experienced, trained, and thus more productive.

Along with corporate profits and living standards, the increase in the growth of productivity could have meaningful positive ramifications for dampening inflation. Mr. Amarnath points out that productivity is growing faster than the pre-pandemic trend level of 1.4%. Should productivity growth run higher than the pre-pandemic trend, then the non-inflationary growth rate of wages should also be higher. There should be less concern over the inflationary impact of higher wage growth relative to its long-term trend.

This recent productivity trend, coupled with anticipated additional productivity gains stemming from capital investment on AI, could partially explain high corporate earnings growth expectations into 2025 as well as the general ebullience in stock markets over the last several months.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2024.