Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, rose 1.2% this week. On Friday, the S&P 500 closed at an all-time high, a mark last reached two years ago.

- The “Magnificent Seven” stocks drove the bulk of the S&P 500’s return in 2023. Is market concentration a risk heading into the new year?

The “Magnificent Seven” stocks – Apple, Microsoft, Alphabet, Amazon, NVIDIA, Tesla, and Meta – were up over 100% on average in 2023 and were collectively responsible for more than two-thirds of the S&P 500’s 26% return. The Magnificent Seven now make up almost 30% of the index’s market capitalization, an unusually high concentration of market value in such a small number of names.

This concentration has led to some handwringing in the financial press. Many are questioning whether these stocks can keep their momentum, or if this narrow breadth represents a risk to market performance in 2024 and beyond.

The author and investor Michael Batnick noted in December that while the Magnificent Seven rose dramatically in 2023, they fared very poorly in 2022. When tech and growth stocks sold off in ’22, the Magnificent Seven were hardly magnificent: they were down almost 50%. After their resurrection in 2023, the Mag Seven have been in-line with the overall market over the last two years.

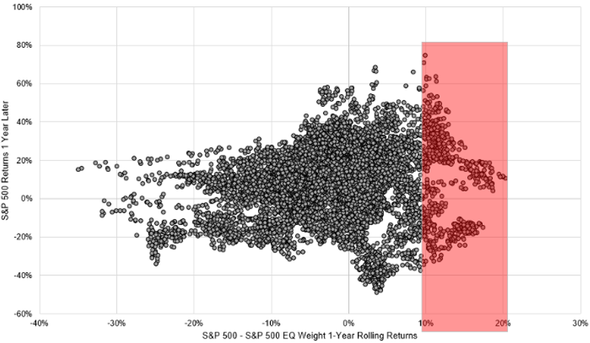

Comparing historical one-year returns of the market cap-weighted S&P 500 index to an equal-weighted index provides a window into timeframes of narrow market breadth outperformance. Those years of strong outperformance by the market-cap weighted index, including last year, have not necessarily portended weak subsequent one-year returns. Those one-year forward returns of the market-cap weighted index are highlighted in red in Mr. Batnick’s chart below:

Source: Michael Batnick, CFA - December 1, 2023

Source: Michael Batnick, CFA - December 1, 2023

Still, the cap-weighted index beat the equal-weight index by a massive margin last year – 26% to 14%. Over the last 30 years, there have been only two other comparable years of such extreme outperformance: 2020 and 1998. One may be tempted to draw parallels between the “dot-com” stock market bubble of the late 1990’s and the market in 2023.

Valuations are not as stretched now as then, however. The Magnificent Seven are extremely profitable, cash-generating juggernauts, unlike most of the “dot-com” names of the late 1990’s which never had a prayer of generating positive cash flows. The Mag Seven names dominate market returns, and they also dominate the market’s earnings growth.

Going against the grain of “long big tech” has not been a winning strategy in recent years. Joe Weisenthal at Bloomberg noted this week that in the BofA Fund Manager Survey, an influential survey of professional asset managers conducted quarterly, some version of overweighting big US technology stocks has been considered the most “crowded” trade on a regular basis for the last six years. Being a contrarian to that crowded trade hasn’t worked very well over that time.

The better way to guard against a “Magnificent” stock market concentration sliding to “Deadly” status is to stick with diversification. Thoughtful allocations to foreign stocks and US small and mid-cap stocks help provide alternative sources of equity returns to US mega-cap stocks. Perhaps these diversifying equity asset classes begin to outperform large-caps on the upside in 2024. Dare to dream.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2024.