Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, slipped 1.5% this week.

- Most financial assets rebounded in 2023 off a historically weak 2022. Last year, the S&P 500 returned 26%.

- What are the factors that could shape markets in 2024?

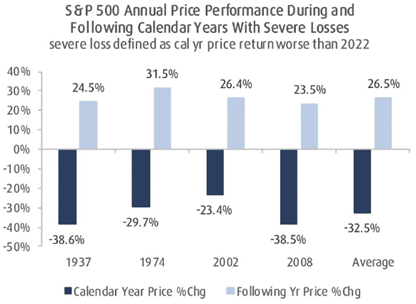

Market analyst Sam Ro recently highlighted a prescient take from Brian Belski, strategist at BMO Capital Markets, made in January 2023. A year ago, Mr. Belski noted that in the past 90 years, the S&P 500 only had four calendar years with worse returns than 2022’s 19.4% loss (1937, 1974, 2002, and 2008). The year following those four years, the index logged 20%+ gains with an average return of 26.5%.

Source: BMO Capital Markets Investment Strategy Group, January 2023

The S&P 500 returned 26.3% in 2023, almost precisely the average return following the four worse-than-2022 years detailed above by Mr. Belski. That is a remarkable and almost eerie outcome, given how low sentiment lurked and the many predictions of economic recessions made when Mr. Belski presented this analysis in January 2023.

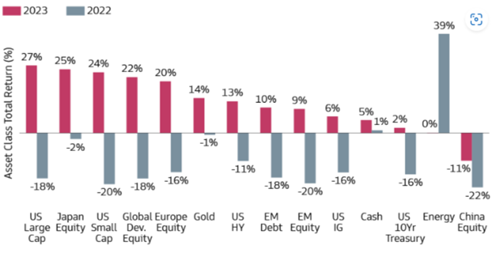

Most financial asset classes rebounded in 2023 as fears of a recession faded, inflation dissipated, and expectations for looser monetary policy from the Federal Reserve took hold. A nice chart from Goldman Sachs shows the mirror reflection of asset class performance in 2023 versus 2022:

Source: Goldman Sachs Asset Management, January 2024

The Fed has not yet lowered its target interest rate, nor has it confessed to having a plan to lower it. However, as Conor Sen at Bloomberg notes, while the Fed can afford to be patient in its deliberations, market participants cannot afford to be. The mosaic of data points to rate cuts in 2024, and markets have shifted to that as the mean policy outcome.

Rallying financial markets are not solely attributable to expectations for lower interest rates – continued economic growth in 2023 versus widespread expectations for recession is also responsible for buoyant markets. That said, what could lower interest rates portend for the economy in 2024?

Higher interest rates over the last few years had a huge negative impact on the housing market. Builders kept building, but there is nowhere close to the massive residential investment hangover à la 2007 to contend with today. Lower interest rates this year should help unfreeze the resale housing market, boosting spending on durable goods and total investment, which could be twin tailwinds for corporate profits.

Lower interest rates could boost private sector borrowing more generally. During the current economic expansion, households have not borrowed to the extent they did in the early 2000’s or in the run-up to the financial crisis of 2008. The difference in the current cycle to those episodes is that leverage is in the public sector, primarily at the federal level because of pandemic-era support. Private sector balance sheets are in a strong position, overall.

The reverberating effects from the events of 2020 are moving further into the past. Perhaps 2024 will reflect a continuing normalization of the economy, with increasing household borrowing to support consumption. When or how that will manifest is as difficult to gauge as the other big variable coming later this year: the elections.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication.

Copyright Indiana Trust Wealth Management 2024.