Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, rose 1% this week.

- A normalization of the composition of consumer spending could boost corporate earnings and keep markets buoyant in 2024.

Last month was the third-best November for the US stock market since 1960, as the S&P 500 climbed over 8%. Bonds rallied as well, yields fell, and the Bloomberg US Aggregate Bond index rose almost 5% in price. November was one of the all-time best months for balanced (60/40) portfolios.

This past Wednesday witnessed two nuggets of encouraging macroeconomic news. First, the Federal Reserve’s preferred gauge of inflation, core PCE, increased by only 0.16% in October. Over the last five months, PCE is up 2.3% annualized – basically at the Fed’s target. Even some of the more skeptical economists such as Jason Furman at Harvard are now conceding that the elusive “soft landing” for the economy is occurring.

Second, the US economy was thought to have grown by 4.9% in the third quarter, ending September. On Wednesday, the Bureau of Economic Analysis revised that figure up to 5.2% annualized.

Markets are rallying upon the presumptions that the Fed will be looking at rate cuts next year given falling inflation as well as the resilience of economic growth. However, it is not reasonable to expect more quarterly real economic growth numbers above 5% heading into next year. It is more likely that the economy slows in 2024.

That does not necessarily mean that stock markets will swoon. As markets analyst Sam Ro pointed out in a note this week, a normalization of the composition of consumer spending could boost corporate earnings and keep markets buoyant in 2024.

During the pandemic, US consumers shifted massively from services to goods. Spending on goods rose well above trend for about a year and a half before falling to trend. The opposite occurred with services: spending on services cratered below trend in 2020 and has been rocketing back to trend as people began once again to travel, attend concerts, and eat in restaurants.

The consumer spending rebalancing process from goods back to services appears to be complete. Should consumers go back to buying stuff at a normal rate, that will be good for businesses. That, in turn, could be better news for the stock market than for the economy.

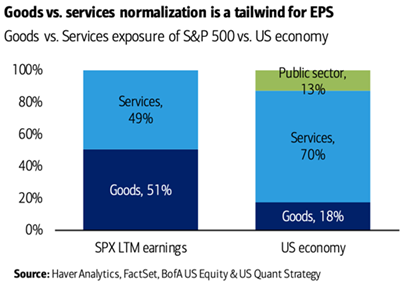

Per Bank of America’s Savita Subramanian, this is because earnings generated by firms in the S&P 500 are goods-oriented, while the overall US economy is services-oriented. “Following the unprecedented shift from goods to services post COVID, we believe the economy is now entering a more ‘normal’ environment with stabilizing goods consumption and moderating services consumption, a tailwind for earnings vs. GDP,” she wrote last week (emphasis added).

The above chart from BofA reflects this distinction: about half of the last twelve months of S&P 500 earnings were goods-driven, while 70% of the US economy is driven by services. Should the service-driven US economy slow next year, corporate earnings may not.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication.

Copyright Indiana Trust Wealth Management 2023.