Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The U.S. equity market, represented by the S&P 500 index, fell 2.5% this week.

- As tech stocks and the market have taken some lumps since late summer, earnings expectations have risen for the next twelve months. That combination of events has led to improved market valuation metrics.

Mega-cap tech stocks, which have been the clear stock market champions for the last several years, were punched around by investors this week. Alphabet (or as most know it, Google) had a rough market response to its earnings release on Tuesday evening: the stock was down almost 10% the following day, dropping more than $166 billion in market value.

Before too many tears are shed for Google, a reminder: the stock is still up over 40% for the year. The tech-heavy NASDAQ is up over 20%. The market overall has sold off from its highs earlier this summer, but the S&P 500 is holding onto decent gains for the year, so far.

Ultimately, expected earnings are what matter most for stock market returns. On that score, it should be no surprise that markets have lifted higher this year, the recent selloff notwithstanding. While news continues to break about third-quarter 2023 earnings, it is likely more helpful to think about what earnings expectations are for the coming year.

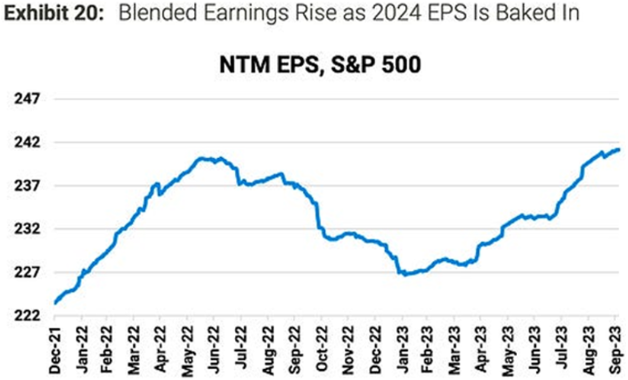

As market analyst Sam Ro notes, S&P 500 earnings are expected to hit record highs in 2024. The below chart shows equity research analyst earnings expectations for the next-twelve-months (NTM) going back to the end of 2021. Since early this year, NTM earnings expectations have been growing:

Source: Sam Ro, FactSet, Morgan Stanley, October 2023

Rising earnings expectations coupled with the selloff of the S&P 500 since July have created improved equity market valuation metrics, such as the price-to-earnings (P/E) ratio. The “P”, or price of the market, has drifted lower in recent months, while the “E”, or expected earnings, has risen. The P/E multiple for the market has fallen. P/E ratios and “multiple analysis” are useful temperature checks: generally speaking, the lower they go, the more attractive they are.

Valuation measures such as the P/E ratio do a poor job at predicting short-term market fluctuations, however, they do a better job at gleaning what future long-term returns may be. As valuations have become more attractive, the odds for decent longer-term stock market returns have risen.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2023.