Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The US equity market, represented by the S&P 500 index, rose 0.4% for the week ending June 9.

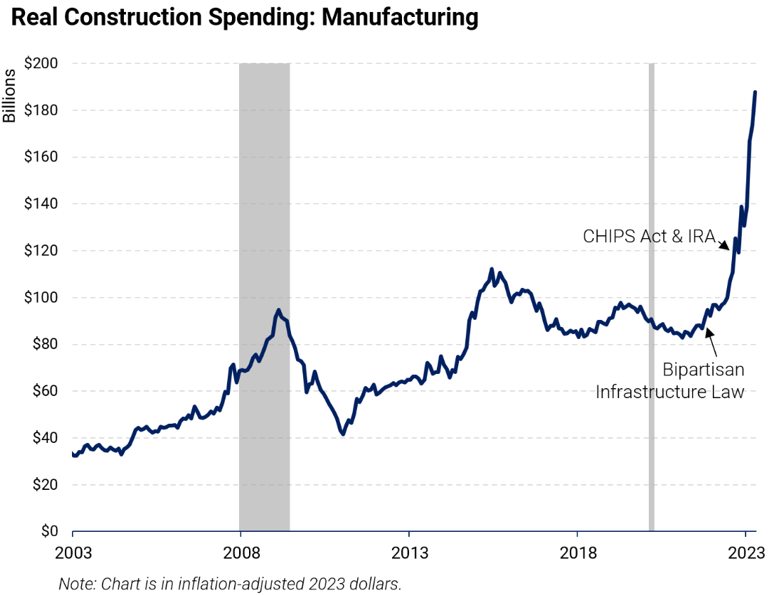

- There is a little noted boom in construction spending by US manufacturers underway in the US. This could be a good sign for corporate profits.

The COVID pandemic put a spotlight upon the consequences of the long-term deindustrialization of the US economy. Critical industries, most notably microchips, were shown to have complex, brittle supply chains which impacted the availability of a wide array of goods, most notably cars.

In response, there has been a surge in political popularity for a more muscular government role to stimulate domestic industrial manufacturing. The Bipartisan Infrastructure Law, the CHIPS Act, and the Inflation Reduction Act, all enacted since 2021, have created strong incentives for manufacturing construction spending on microchip fabrication plants, battery factories, and electric vehicle assemblies.

Among the giant US companies to get on board are Intel Corp. — which is investing some $20 billion to build a chip fabrication plant in Ohio — and Ford Motor Co., which broke ground last year on a Tennessee factory that will make electric trucks.[1] The aggregate response to these policies can be witnessed in the below chart from the BLS: the manufacturing share of construction in the US is at a 30-year high.

Source: BLS, Census Bureau, 2023

Those spending numbers are inflation-adjusted, which only makes the growth in construction spending by manufacturers more remarkable.

Construction expenditure is referred to as “capital investment” by economists. “Capital investment” in this sense does not refer to buying stocks or bonds, but rather the creation of wealth in the form of building factories and machines or creating intellectual property.

Some economists argue that “real” capital spending in the form of building a plant is equivalent to creating “intangible” capital in the form of patents, for example, although the recent pandemic experience may provide evidence to the contrary. In addition to shoring up supply chains, there is value in the learning process of making stuff that builds over time.

Capital investment is also a critical source of corporate profits. For the company that makes a capital investment in a factory, it exchanges one asset (cash) for another asset (the factory). The net worth of that company has not changed. However, the company that built the factory receives the revenue for the work. That represents profits.

Residential construction is by far the biggest share of the construction industry, and it has cooled in the face of higher interest rates. Data on housing starts has shown signals of bottoming, however, and homebuilder stocks have been amongst the best-performing this year.

Historically, investment has been a vital source of corporate profit growth, but it has waned over the last few decades relative to GDP. The recent rising share of manufacturing investment could be a sign that overall investment is staging a comeback as the essential driver of corporate profits.

Editor’s note: our weekly update will return June 24.

[1] “Factory Boom Sweeps US With Construction at Record $190 Billion”, Ben Holland and Alexandre Tanzi, June 1, 2023, Bloomberg

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2023.