Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The US equity market, represented by the S&P 500 index, rose 2.7% for the week ending January 13.

- The European economic picture is brightening, and its stocks are cheaper relative to U.S. equities. Global investors with underweights to European stocks may be caught offsides as a result.

2022 held many surprises for investors. It was the only year since 1970 when U.S. stock and bond market returns were both negative. The Federal Reserve also kicked off its fastest monetary policy tightening cycle in the last forty years.

Perhaps the most surprising outcome was that international developed markets stocks outperformed the U.S. stock market for the first time since 2016.

When the dollar strengthens relative to the euro, yen, and British pound sterling, that is a headwind for U.S. investors in foreign stocks denominated in those currencies. At its highest point, at the end of September, the dollar was up almost 20% versus a basket of foreign currencies. The dollar weakened heading into the end of 2022 but still ended up over 8%.

Even with the currency drag, foreign developed markets stocks – those primarily in western Europe and Japan – outperformed the S&P 500 for 2022. Foreign stocks were down 14% versus the S&P’s -18% return. In the fourth quarter alone, foreign markets were up 16% versus the S&P’s 8% return.

In local currency terms, the gap was much wider in 2022 – foreign stocks were only down 7% for the year. International equities have continued their outperformance in the two weeks to start 2023.

This is all eye-opening because investor sentiment for European stocks went from poor to dreadful over the last two years. The war in the Ukraine and its impact upon energy prices, particularly natural gas, was the primary reason for the deepening investor gloom. The European Central Bank’s (ECB) decision to cure that energy-driven inflation with higher interest rates did not help matters. Economists have widely predicted a deep recession for the eurozone and for the UK in 2023.

Some of those clouds began to part late last year. European natural gas prices are in free-fall thanks to a weirdly warm winter, stockpiling of natural gas, energy-efficiency drives, and industries switching to gas alternatives.[1] That is expected to help ease headline inflation in Europe’s major economies.

Economists have begun to take note. Goldman Sachs withdrew its call for a recession in Europe this week, adding that China’s reopening is a huge positive for Germany and other major European exporters to China.

The economic picture is brightening in Europe, yet markets still have foreign stocks valued cheaply relative to U.S. stocks. The foreign equity price-to-earnings ratio (P/E) is usually at a discount to the U.S. market’s P/E ratio. The average discount over the last twenty-five years is about 14%. That disparity now stands closer to 29%, a historically cheap relative valuation.

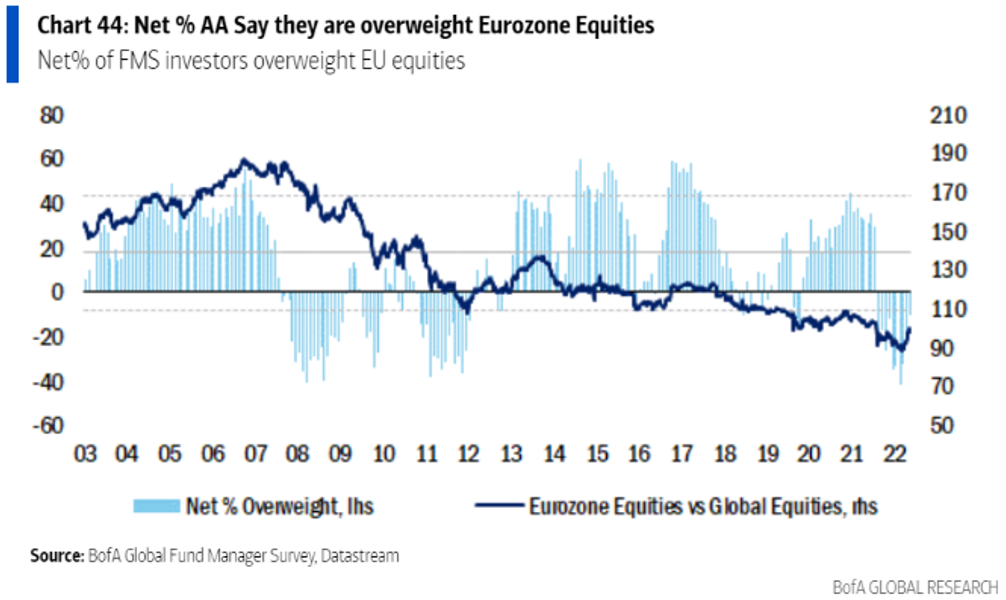

This cheap relative valuation is partly the outcome of the shunning of foreign stocks over the last seven years. Bank of America’s monthly survey of global fund managers reflects a record underweight in euro zone stocks by institutional investors.

Source: Bank of America Global Research, Reuters, January 13, 2023

Markets change quickly. Investors who have been structurally underweight international equities prior to the fourth quarter of 2022 may now be caught offsides by recent positive developments in Europe.

[1] “Europe weathers the storm” by Mike Dolan, Reuters, January 13, 2023

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2023.