Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The US equity market, represented by the S&P 500 index, rose 1.6% for the week ending February 3.

- Investors are reassessing the range of outcomes for the US economy in 2023 and must now include the possibility that the US experiences strong growth this year.

The wide consensus amongst economists and investors is that the US will enter economic recession in 2023. Fidelity Investments, for example, puts the odds on a recession at 75%. Above all other contributing factors to this line of thinking is that the Federal Reserve has been in interest rate hiking mode to put the brakes on economic growth, slow employment gains, and squash inflation.

About a month ago, a few voices began to contemplate an economic “soft landing” instead, despite the Fed’s best efforts, where the economy was able to bump along with moderate growth, a decent labor market, and disinflation. In recent weeks, economic data has been pointing to the growing possibility of a soft landing for the economy.

This week’s BLS payroll report and other data prints has forced investors to consider a “door number three” for the US economy in 2023: strong economic growth with no “landing” at all. Per the BLS, the economy added 517,000 jobs in January versus consensus expectations for 185,000. The unemployment rate fell. Those under the age of 55 in the US have never seen the unemployment rate so low.

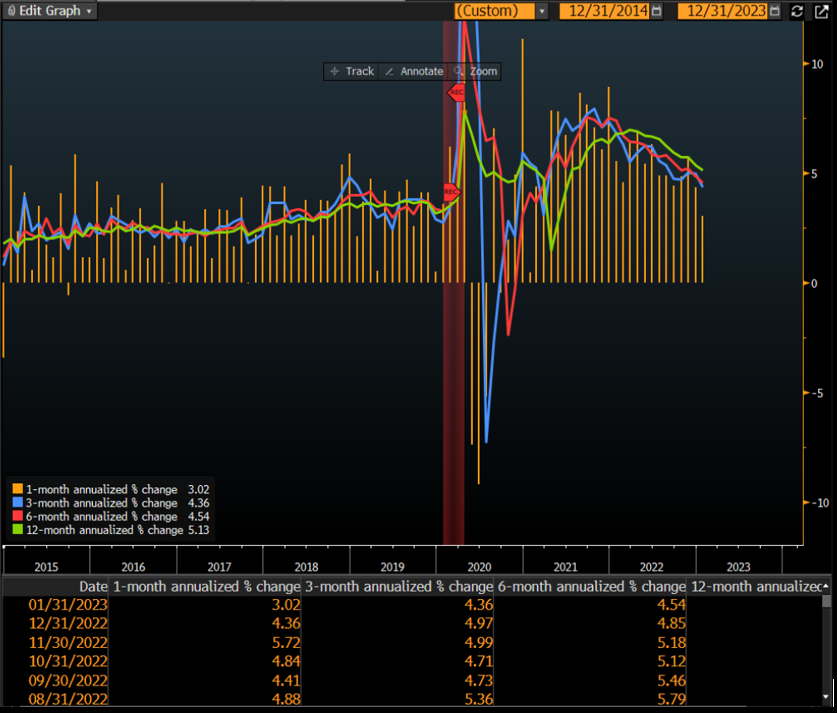

The most striking trend is that wage growth and inflation are slowing while the economy continues to add jobs and unemployment falls – an “immaculate disinflation” scenario. Those four things do not add up in most economic models. There must be some at the Fed who are flummoxed by current events, as wages are unambiguously rolling over per the below chart of average hourly earnings:

Source: Matthew Boesler, Bloomberg, February 3, 2023

The Fed does not want to overtighten monetary policy should wage growth and inflation continue their current downward trajectory, but it also is becoming apparent that the US economy is somewhat resilient to higher interest rates. Most current homeowners likely have mortgages well below current rates. This week the 30-year fixed mortgage rate fell below 6%. Debt service overall relative to income is low in the US, and that means household spending on other things has continued.

Equity markets have sized up the potential for a no-landing scenario this year and into 2024, and investors are trying to get ahead of the curve. Stocks in RV, pool, boat, and motorcycle companies are rallying as investors contemplate sustained household demand rather than a recession.

The no-landing scenario carries its own near-term risks. While the slowing-inflation trend may continue toward the Fed’s 2% goal, there could be pockets of inflation heat along the way. “Immaculate disinflation” could face renewed upward pressure should demand for goods overheat in 2023 and 2024. In that case, the Federal Reserve would be ready – and, as we have seen, very willing – to continue interest rate hikes.

_______________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2023.