Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The US equity market, represented by the S&P 500 index, was up over 1% for the week ending December 2.

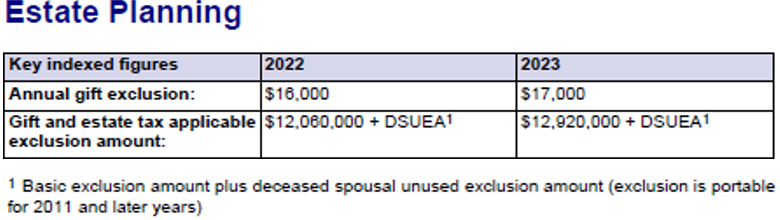

- Tax brackets, annual gift exclusion, and estate tax exemption amounts for tax year 2023– a year when inflation may be dissipating - have all been adjusted higher due to realized inflation in 2022.

Inflation has been the only macroeconomic and capital market story that has mattered in 2022. Over the last few months, a constellation of various data points appears to show it is on the wane, or at least stabilizing. The Federal Reserve’s preferred measure of inflation, the Personal Consumption Expenditures (PCE) index, rose by a less-than-expected 0.2% in October.

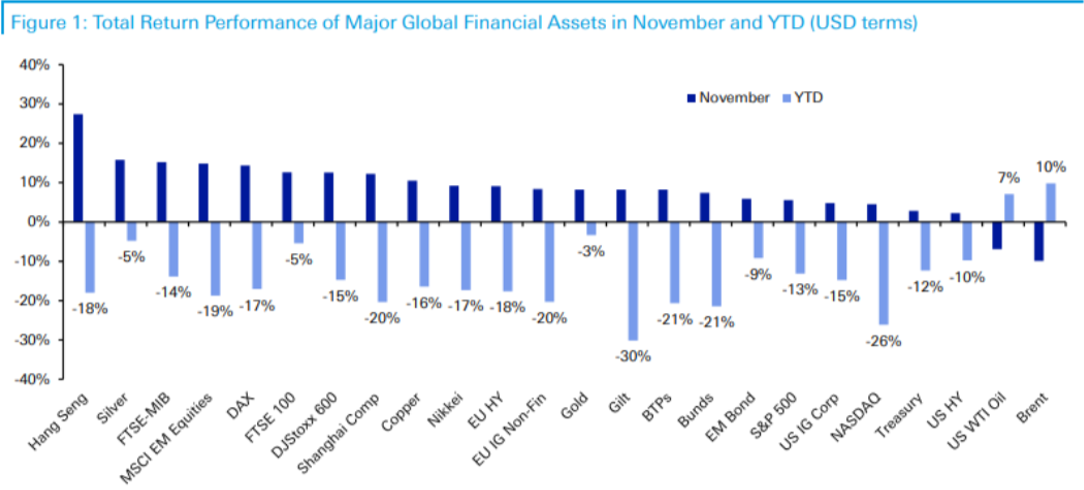

The apparent slowing of inflation and modestly dovish comments from Jerome Powell, the chairman of the Fed, have caused medium- and long-term interest rates to fall and for the dollar to weaken. These macro conditions sparked a rally across virtually every single financial asset class in November per the below chart from Deutsche Bank, via Bloomberg:

Source: Bloomberg, Deutsche Bank, December 2, 2022

Measures of inflation, by nature, are backward looking, and the Fed is not the only government entity which is responding to inflation in the rear-view mirror. The IRS has also adjusted retirement plan contribution limits, annual gift exclusions, and lifetime estate and gift exemptions for 2023 based upon inflation over the last year. Income brackets and the standard deduction have also been bumped higher for 2023 due to realized inflation in 2022.

Source: Broadridge, November 2022

For individuals, these changes represent a bit of income tax relief and could provide opportunities for more tax-effective estate and retirement planning.

In the aggregate, these changes could represent a fiscal tailwind in 2023. Guillermo Roditi Dominguez notes that for the median employed person, the changes in the income brackets alone would represent an increase in take-home income of 0.84%, all else equal. At a macro-level, that represents $55 billion in fiscal stimulus. That all sounds like small potatoes, he notes, however it is equivalent to the economy adding 906,000 full-time payroll employees.

From that perspective, the 2023 tax updates aren’t too shabby. While inflation is rightfully and widely hated, should it indeed be slowing, it may have a few underappreciated silver linings in the coming year.

______________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2022.