Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The US equity market, represented by the S&P 500 index, was flat for the week ending April 21.

- The financial media discourse continues to focus upon “late business cycle” indicators flashing recession warnings.

- Housing is a surprise positive “early business cycle” indicator currently flashing future growth.

There are almost always data points in the ocean of business surveys, yield curves, and stock charts to support one narrative or another. Well-known economic and market pundits continue to focus upon negative late business cycle indicators flashing recession warnings. If a recession occurs in 2023, which is the overwhelming consensus, it would be the most predicted recession in history.

There are a few signs, however, that the economy stands somewhere early in the business cycle and is positioned for growth.

Investors tend to focus upon housing data as homebuilding is an economically fruitful activity. Along with construction labor, consider all the stuff that goes into a new house. Housing is viewed as a leading indicator for economic activity.

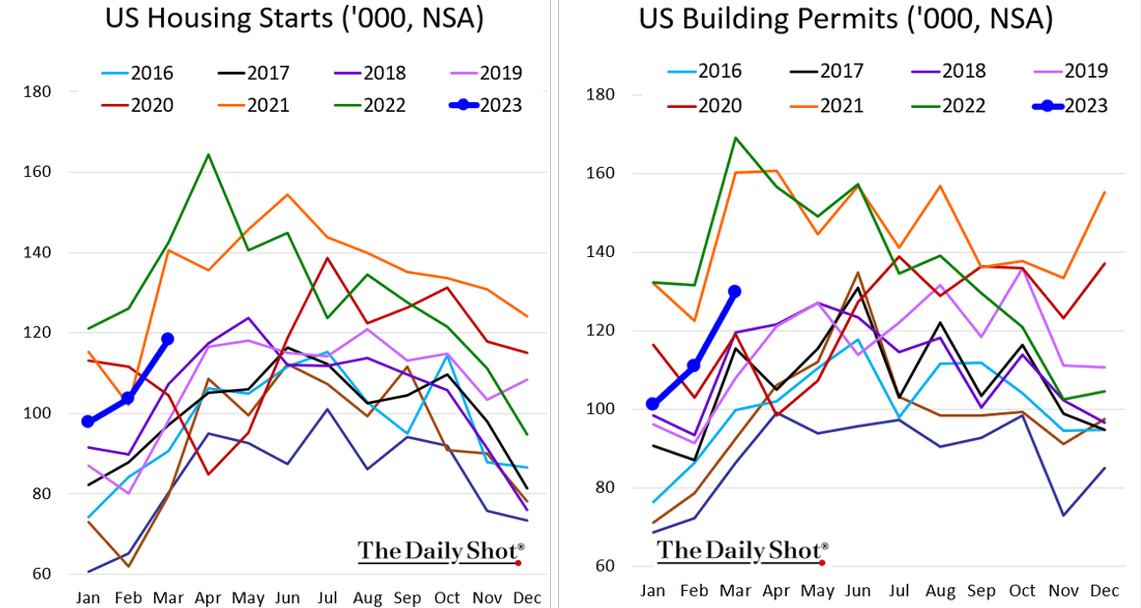

Based upon the Federal Reserve’s interest rate hikes, the assumption was that housing would be crushed. That has generally been the case for existing home sales, however builders have seen a resurgence in 2023. Housing starts and permits are up, and data has been surprising to the upside.

Source: The Daily Shot, April 19, 2023

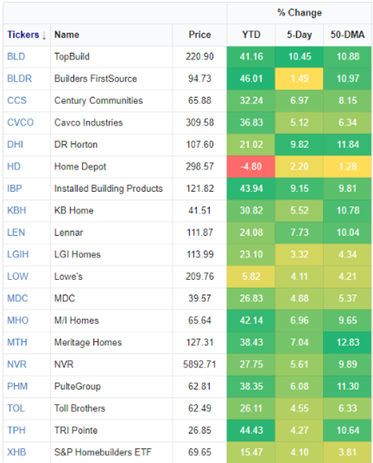

Homebuilder stocks are flying. Bespoke Investment Group notes that most homebuilder names are up 30-40% in 2023 after rallying 5-10% over the last week.

Source: Bespoke Investment Group, April 21, 2023

As long-term interest rates have ticked down this year, mortgage rates have followed, providing a boost for housing. The average 30-year fixed rate mortgage peaked in November at 7.1%; the average now stands at 6.3%.

What else could be providing a boost to the economy and supporting demand for housing? The US government fiscal position, a headwind in 2022, is now a tailwind. There will be political debates surrounding government spending, the debt ceiling, and the impact of deficit spending on inflation. Those debates aside, the government’s fiscal position is in expansion territory.

The consensus may be right: the US could easily slip into recession this year. There are more than a few reasons to think that a slowdown might not be imminent.

__________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2023.