Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The US equity market, represented by the S&P 500 index, rose 1.4% for the week ending March 25.

- Interest rates have plunged over the last week, reflecting the view that the Fed’s interest rate hike on Wednesday would be its last of this cycle. The collapse in rates has spurred a reversal in equity market leadership.

The Federal Open Market Committee (FOMC), the part of the Fed that makes interest rate decisions, hiked its target interest rate 0.25% this week in the face of turmoil in the US banking system. Although its tone was softer, the FOMC continued its mantra that further rate hikes this year may be warranted to deal with inflation.

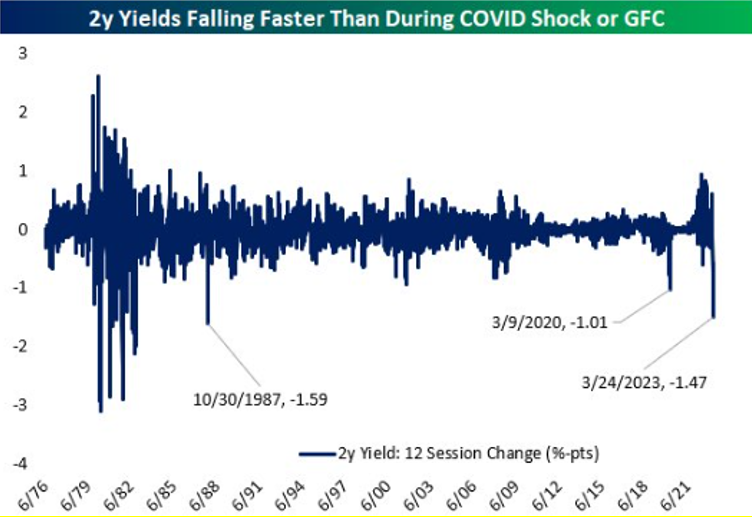

The bond market proceeded to deliver its verdict on the Fed’s outlook by driving interest rates down. While long-term interest rates have fallen, the swiftness and magnitude of the drop in the two-year Treasury note cannot be overstated. It has fallen faster and further than it did during the Great Financial Crisis in 2008 or the COVID shock in 2020, down 1.5% over the last 12 trading days.

Source: Bespoke Investment Group, March 24, 2023

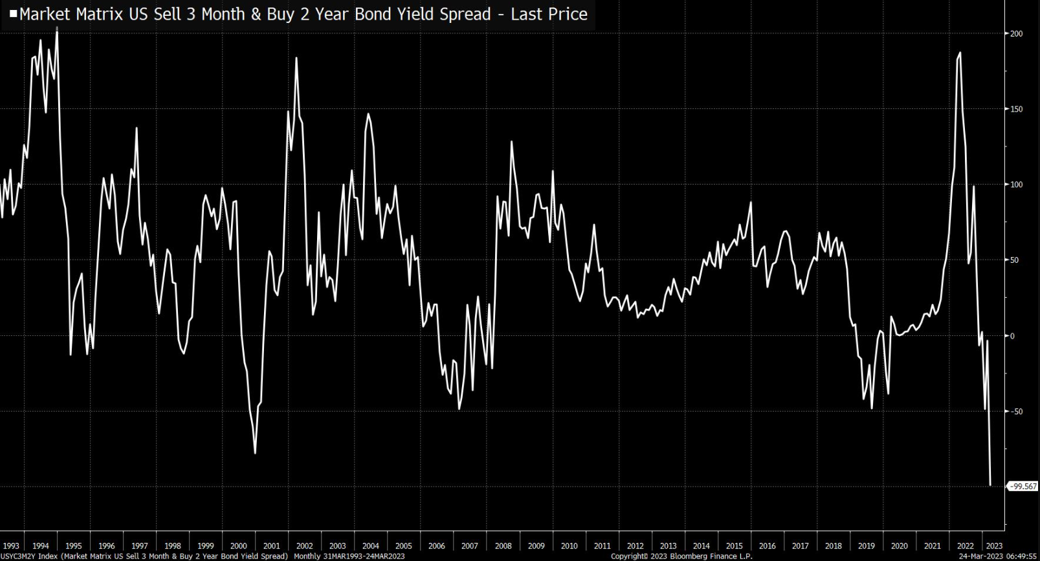

While the inversion of the two-year to ten-year yield curve is rapidly un-inverting, the spread between the yields on the three-month (4.6%) and two-year (3.8%) notes has never been so inverted.

Source: Joe Weisenthal, Bloomberg, March 24, 2023

Given recent events, the bond market is delivering a blunt message to the Fed: you’ll be cutting rates before you know it to deal with a recession of your making.

The collapse in interest rates has spurred a change in US equity market leadership from value to growth. US large-cap growth names, those darlings of the tech sector over the last decade, came under fire in 2022 as interest rates rose. Investors piled into value names which, for various debatable reasons, are less exposed to rising interest rates. It was heralded as perhaps a new day for value investing, which had been out of favor for years.

Alas, the reversal has been reversed. Growth is back in vogue. The NASDAQ 100, which lists the largest tech companies in the world, is up over 16% this year. This rapid development over the last two weeks has hammered hedge funds using trend-following strategies, a stark reminder of the unpredictability of leadership between the growth and value factors in equity markets.

Falling interest rates have meant that bonds have gained in value over the last few weeks. That will help bank balance sheets (and investor portfolios) and should help stabilize the financial services sector. Also, now that banks may post their underwater US Treasury bonds at par value as collateral at the Fed should they need to borrow to cover deposit outflows, it seems logical that would make Treasuries more valuable, reinforcing the recent downward move in interest rates.

Whether the bond market is right about a recession and the Fed cutting rates in the coming months is another matter. As James Bullard, the President of the St. Louis Fed, pointed out on Friday, financial stress can be harrowing but also tends to reduce the level of interest rates (as we are witnessing). Lower rates, in turn, tend to be a tailwind for the macro economy.

Editor’s Note: Our weekly email will be on hiatus until mid-April.

______________