Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The US equity market, represented by the S&P 500 index, rose 2% for the week ending March 3.

- When interest rates (or “yields”) rise, bond prices – or any investment paying a stream of cash flows – fall, and vice versa. This relationship is not linear, however.

In 2022, the Federal Reserve raised its overnight target interest rate at a faster pace than any other time over the last forty years, and that action raised interest rates across the yield curve. When yields rise, bond prices fall. That decline in price is part of the total return calculation for bonds, along with interest income.

The sensitivity of bond prices to changes in interest rates (or “yields”) is referred to as “duration”. While it is often quoted in “years”, duration is the percentage change in a bond’s price for a 1% move in market interest rates.

The higher the duration of a bond or a bond portfolio, the more sensitive it will be to fluctuations in rates. That is why the total return of the iShares 20+ Year Treasury Bond ETF was -31% last year. Sure, it paid a coupon of 3%, but it had a duration of over 18, so its price sank by well over 30% as interest rates rose.

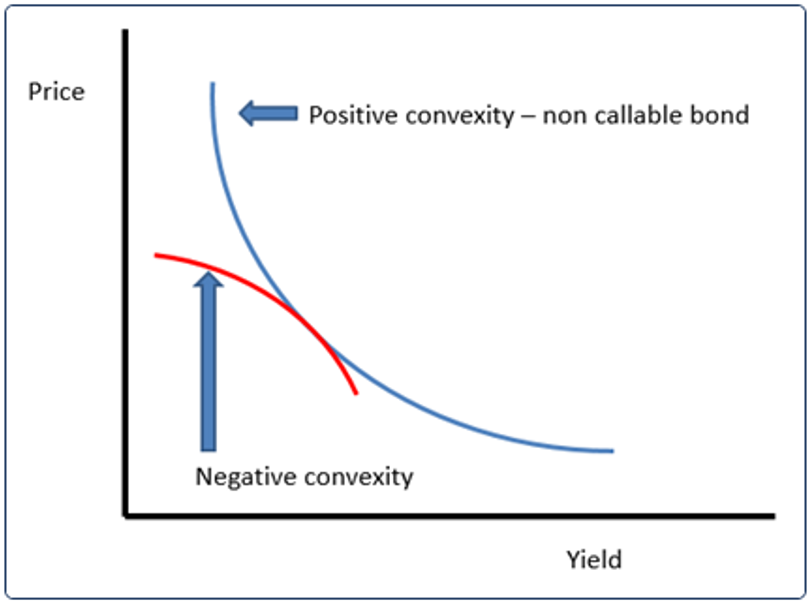

The relationship between market yields and bond prices is not linear, however. As yields go higher, bond prices continue to fall - but they do not continue to fall as much. This non-linearity is described by a bond’s “convexity”, the curve of the relationship between price and yield, and can be conceptualized in a simple chart:

Figure 1: Relationship between market yields and bond prices.

Some bonds have negative convexity, such as those with call provisions. However, most sovereign bonds (including US Treasuries) and corporate bonds are non-callable and exhibit positive convexity, which means as yields move higher, bond prices fall but at a slowing rate. At extremely high yields, bond prices do not move much at all when yields change.

This may carry implications for fixed income in 2023. Interest rates are once again nudging upwards. This week, for the first time since 2007, the entire US Treasury yield curve – every single US Treasury bond – yielded over 4%.

Should interest rates move substantially higher, bond prices will fall but more slowly than they did last year. Convexity is why the bond market losses of 2022 are not likely to repeat to the same degree in 2023.

Equity prices are also sensitive to fluctuations in interest rates. The future free cash flows generated by publicly traded firms are expected to occur into the distant future – into perpetuity – so equities may be considered “long duration” and sensitive to rate changes as a result. Soaring interest rates from a low level explain why stocks sold off in 2022, to some extent.

While there is little research on the topic, there is some evidence that stocks also have positive convexity characteristics. It is difficult to precisely calculate duration or convexity on stocks because many factors apart from interest rates impact equity price movements. The future free cash flows generated by firms are more variable than interest payments from US Treasury bonds.

That said, convexity could partly explain why equities have proven somewhat resilient (so far) to higher yields in recent weeks.

___________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2023.