Indiana Trust Wealth Management

Investment Advisory Services

by Clayton T. Bill, CFA

Vice President, Director of Investment Advisory Services

- The US equity market, represented by the S&P 500 index, rose 2.5% for the week ending January 27.

- Large-cap growth-style stocks had a brutal 2022, whereas value-style names fared better. Growth’s valuation premium over value has come down dramatically.

Heading into 2022, US stocks categorized as large-cap growth had outperformed value-style stocks for over five years. Growth stocks were king of the US stock market for years.

Stocks can be sliced and diced in countless ways, but typically the more expensive a stock is relative to its underlying earnings or book value and the higher its expected earnings growth, the more likely that it will be classified as a growth stock. Value stocks tend to have lower price-to-earnings or price-to-book ratios and lower but stable earnings growth expectations.

Growth indexes are unsurprisingly dominated by high-flying technology stocks. Tech names represent roughly half the most-followed growth index, the Russell 1000 Growth Index. That roster is led by names such as Apple, Microsoft, and Amazon. Tesla is in the top ten of the Russell 1000 Growth, as well.

Value indexes are comprised of boring insurance and oil companies. The top three names in the Russell 1000 Value index are Berkshire Hathaway, Johnson & Johnson, and Exxon Mobil.

A major shift occurred last year in US equity markets. Rising interest rates in 2022 put a dent in expensive tech stock valuations, leading to a broad downswing in growth-style stocks. Mega-cap tech names were not left unscathed. Large-cap growth was off almost 30% last year. The higher the interest rate regime, the less investors are willing to wait for uncertain cash flows occurring in the distant future.

Big value-style names held up much better, down 7.5% in 2022. They are not as interest rate sensitive – they have lower “duration” – because their cash flows are stable and predictable.

Another boost for value stocks last year was that previously unloved sectors prominently featured in the value sphere became the darlings of the stock market. The energy sector was up over 60% as oil prices rose. Energy represents almost 10% of the value index, but alas there are no energy names to be found in the growth-style world.

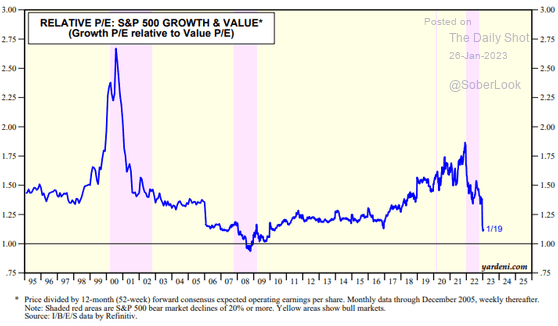

Based upon their relative price-to-earnings ratios, growth had become quite expensive versus value after 2017 - although growth’s relative valuation never soared to the stratospheric heights of the tech bubble at the turn of the millennium.

Source: The Daily Shot, January 26, 2023

As the above chart shows, after its 2022 reckoning, the growth-style is now closer to its historical average premium over value stocks. This suggests that further pain in growth stocks could be limited. The Russell 1000 Growth index is up almost 10% since the start of 2023 versus the Value index’s 5% return.

Style investing has been around for some time. For some, paying attention to style has become a bit passé. While not to the extreme of the 2000’s tech bubble, last year was another reminder that tilting heavily to one style versus another introduces portfolio risk. Style still matters, as some equity managers rediscovered last year, and fast-changing style performance is incredibly difficult to predict.

_______________

IMPORTANT DISCLOSURES: All info contained herein is solely for general informational purposes. It does not take into account all the circumstances of each investor and is not to be construed as legal, accounting, investment, or other professional advice. The author(s) and publisher, accordingly, assume no liability whatsoever in connection with the use of this material or action taken in reliance thereon. All reasonable efforts have been made to ensure this material is correct at the time of publication. Copyright Indiana Trust Wealth Management 2023.